Lawyers are among the most reviled service professionals in American culture. We’re so disliked that even lawyers don’t have a lot of friends who are lawyers. I mean, who doesn’t love a good lawyer joke? Q: What’s the difference between a good lawyer and a bad lawyer? A: A bad lawyer makes your case drag on for years. A good … Read More

Devils, Details, and Deadlines: Calculating the Penalty Period

If you can’t prove you didn’t make a transfer to get on Medicaid, that transfer becomes a disallowed transfer. And that’s bad because a disallowed transfer means a penalty period will be imposed, delaying the time you are allowed to receive Medicaid coverage for the nursing home. The real question becomes: how do you calculate the penalty period? [Read More]

The length of the penalty period depends on the value of the assets transferred.

Watch Your Language: Transfer

Seems obvious, right? In daily life, a transfer happens when property changes hands. You can transfer money between bank accounts or transfer germs between school children. In grilling and smoking, “transfer” means removing food from the grill or smoker. Unfortunately, it’s not that simple in the Medicaid world. [Read More]

You Need a Medicaid Guidebook – and an Expert Guide, too

Iowa Medicaid – sometimes called Title XIX (Title 19) – is a mashup of federal statutes and regulations, state-specific rule tweaks, and both formal and informal agency policies. The system itself is intricate enough, but then the individual case workers who process Medicaid applications don’t always apply the rules in the same way. It’s virtually impossible to navigate the maze without a guide. [Read More]

Long-Term Care Planning with Joe Friday and Columbo

One thing you could always count on from Joe Friday was direct questions meant to collect the information he needed to solve his case. Columbo was famous for collecting every detail needed to close his cases. And, like Joe Friday, Columbo followed the facts to their logical conclusion. An elder law expert will follow much the same approach, collecting detail upon detail through one or more interviews with you and your family then using those details to analyze and apply the multitude of tools available. [Read More]

Why Your 18-Year Old Needs an Estate Plan

The law says that your kids magically become adults the day they turn 18. Regardless of their ability to wash a load of laundry or prepare a meal for themselves, our society has decided that their 18th birthday is your kids’ moment of emancipation from the totalitarian regime that is – according to your kid, anyway – your parenting. They’re not done with high school yet, but they’re certainly capable of reading and understanding a residential lease or property disclosure statement. Right? [Read More]

101 Death Hacks: A Cheat Sheet for Arranging Your Affairs Before You Die – 1-20 [Part One]

Everyone loves ‘hacks’. From party hacks to Halloween costume hacks to garage organization hacks, if you want to simplify a project or task you can do a quick Google search or pay a visit to the Lifehacker website to find ways to effectively shortcut a complicated job. Why should that be any different for estate planning? Well, a DIY will is probably going to create more problems than it solves, but you can still simplify the estate planning process. Check out this first post in our five-part series to learn how. [Read More]

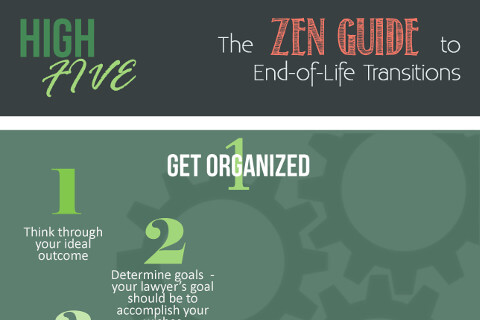

High Five: The Zen Guide to End-of-Life Transitions

We’ve been talking this month about the Zen of planning for end-of-life transitions, but even the five step approach we’ve been talking about can seem intimidating, especially when you’re reading words on a page (or screen). So we’ve simplified things even more with our infographic: the Zen Guide to End-of-Life Transitions. [Read More]

High Five: The Zen Guide to Probate

Life is full of transitions, and the end of someone’s life can be the most significant transition of all. Amidst the emotional challenges that come with laying a loved one to rest, it can be intimidating to discover that you’ve been designated as the executor of your loved one’s estate. Then you find out you are a fiduciary and the heavy responsibility that imposes, and suddenly you’re feeling like a fish out of water. [Read More]

- Page 1 of 2

- 1

- 2